41 put option payoff diagram

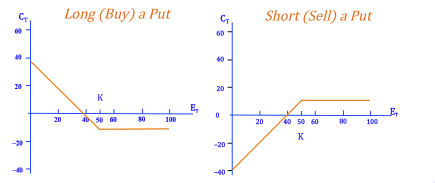

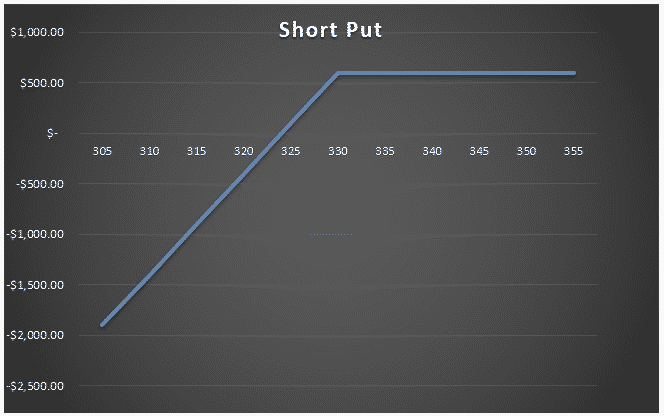

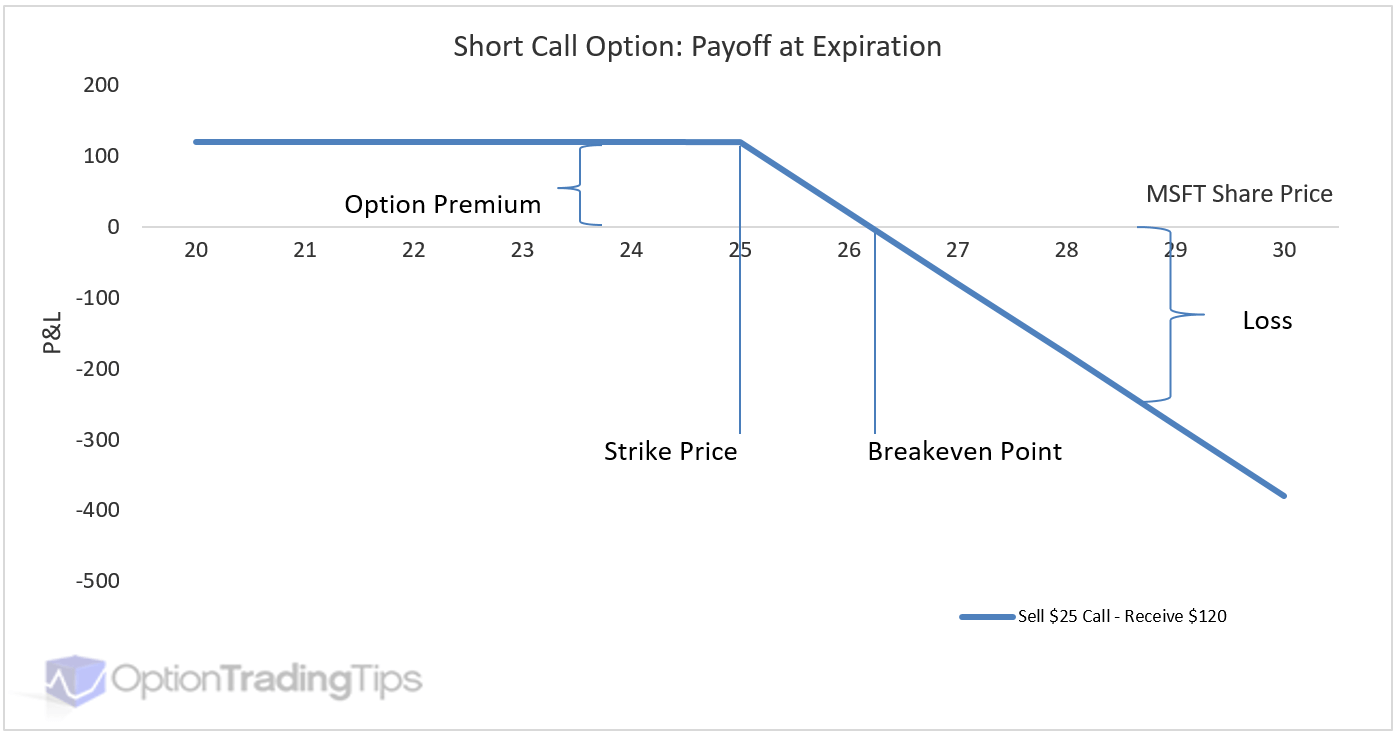

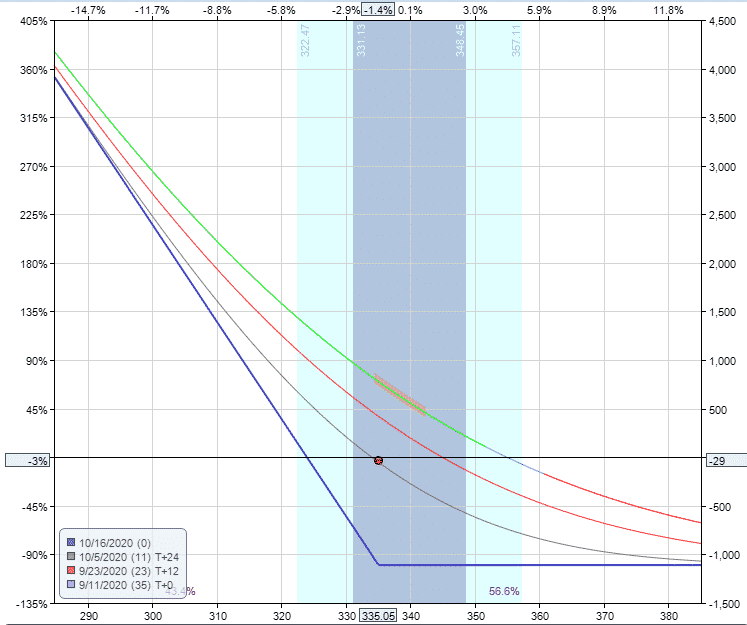

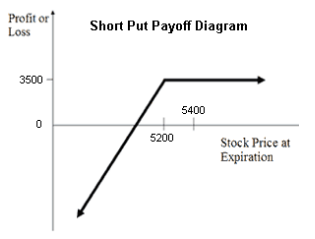

A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. If you're seeing this message, it means we're having trouble loading external resources on our website. Short Put Payoff Diagram A short put option position is a bullish strategy with limited upside and limited (but usually very high) risk. The position is initiated by selling a put option with the intention to buy it back later at a lower price or waiting until expiration and hoping it will expire out of the money. See the payoff chart below:

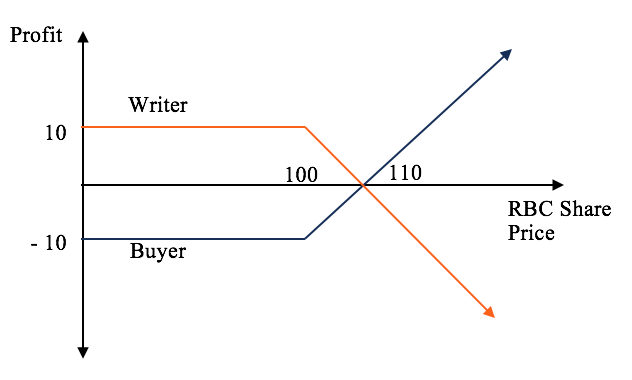

The option buyer can sell their option and either minimize loss or realize a profit, depending on how the price of the option has changed since they bought it.

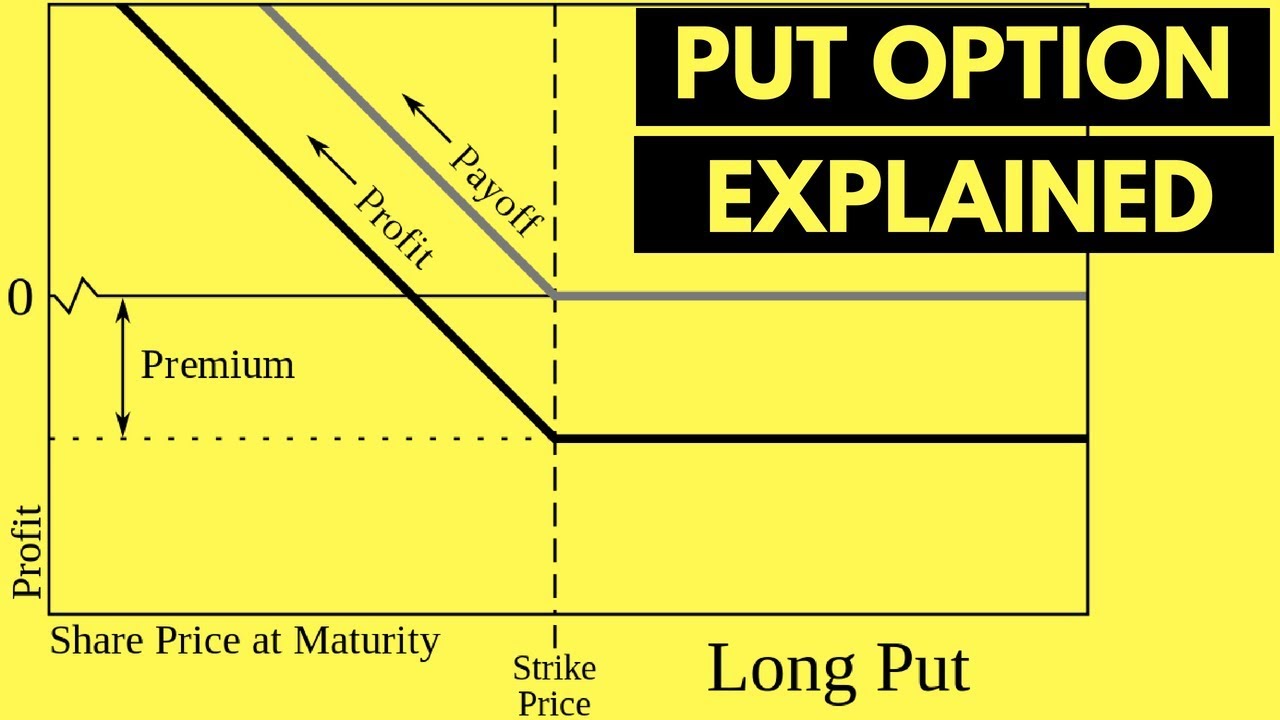

Put option payoff diagram

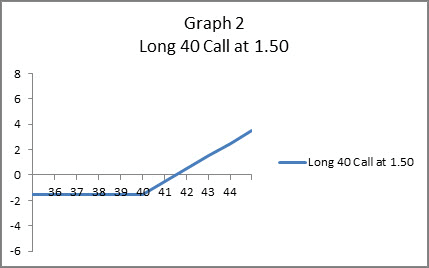

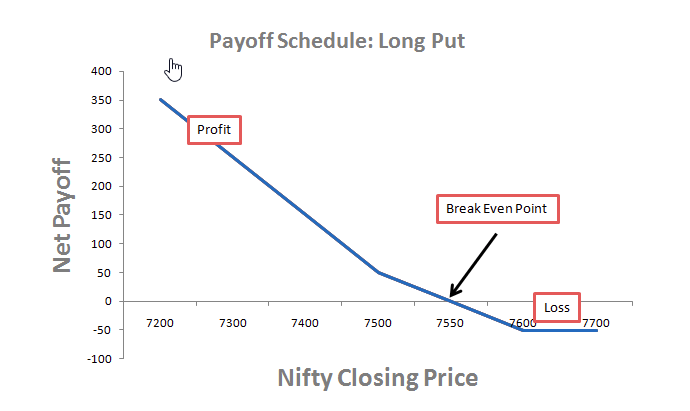

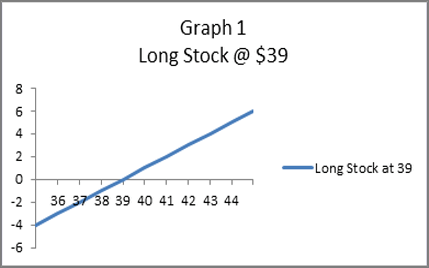

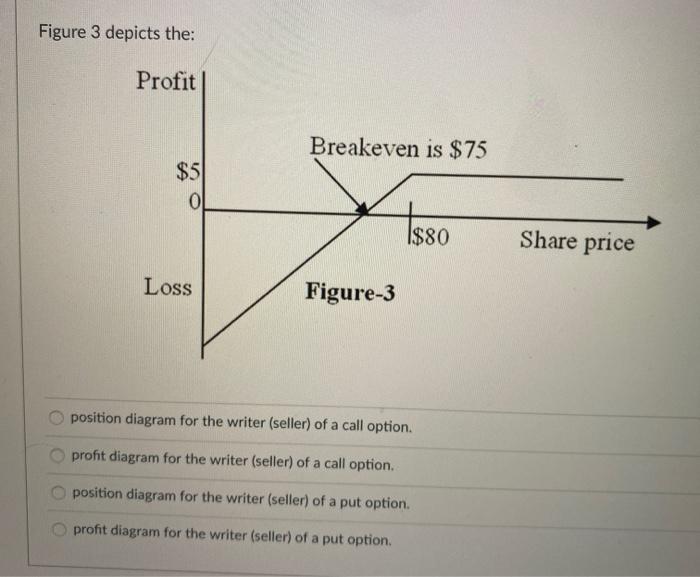

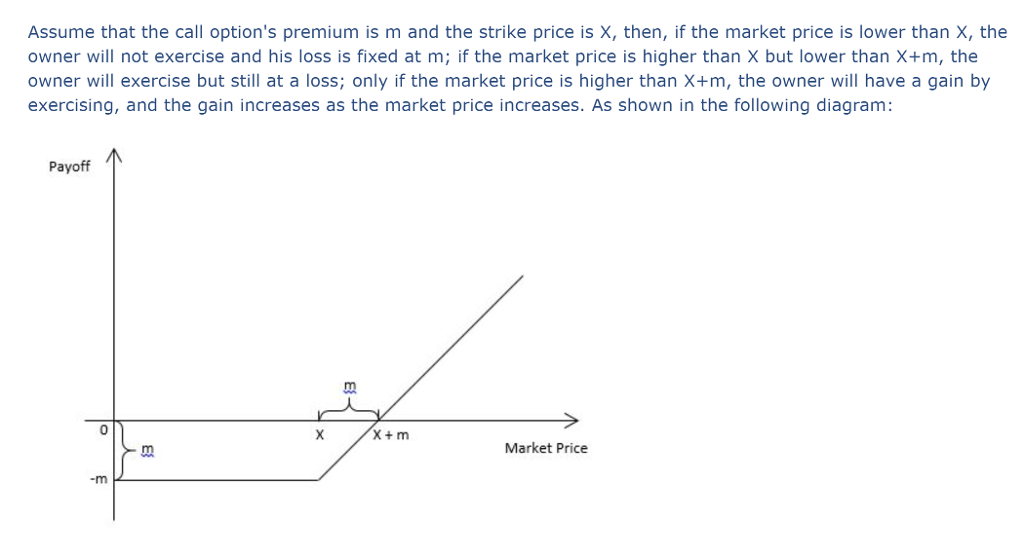

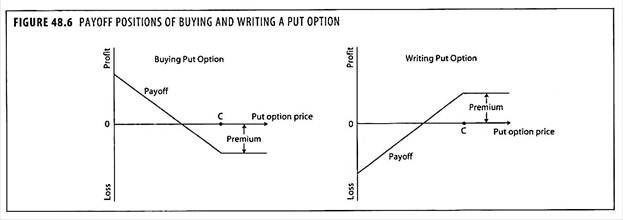

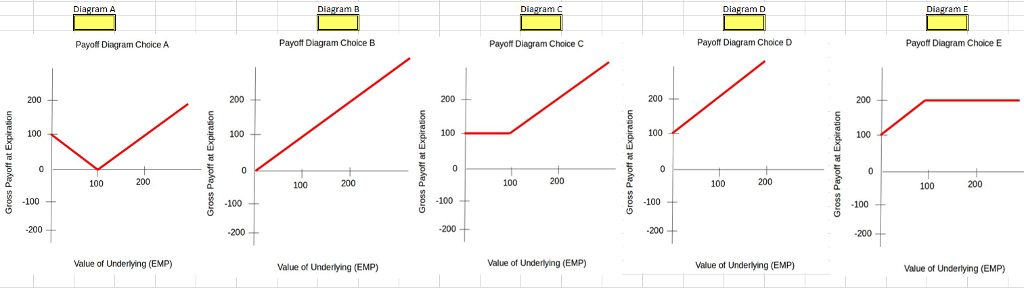

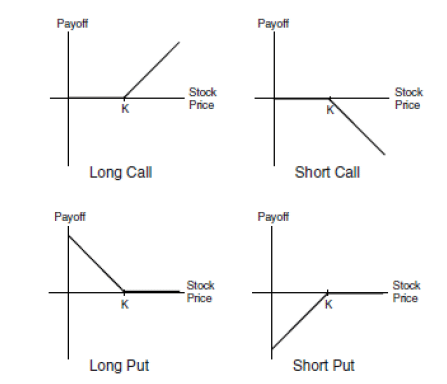

Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below: To Open your Demat & Trading account with Fyers Securities, Please click on below link http://partners.fyers.in/AP0209 Please fill in your details, Fyers rep... Feb 06, 2017 · Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of options. As option probability can be complex to understand, P&L graphs give an instant view of the risk/reward for certain trading ideas you might have.

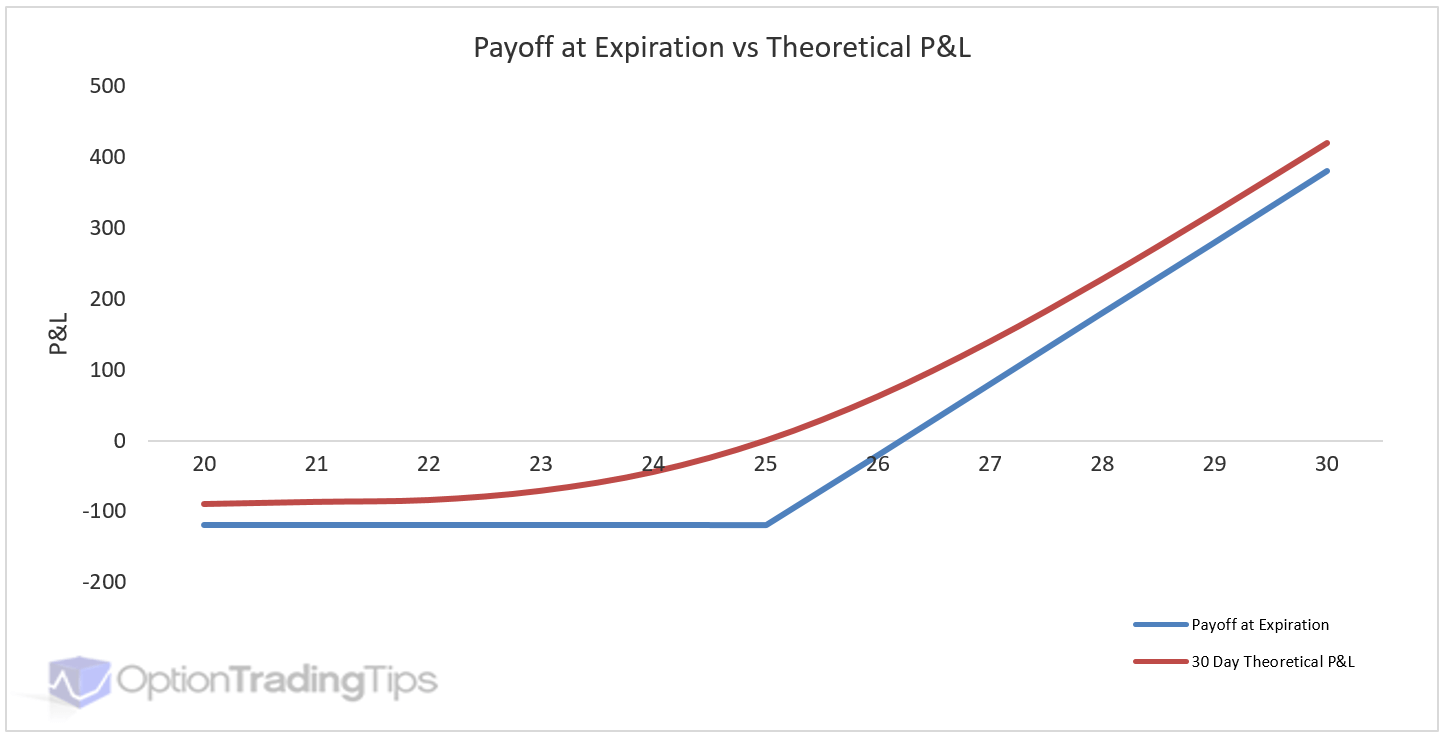

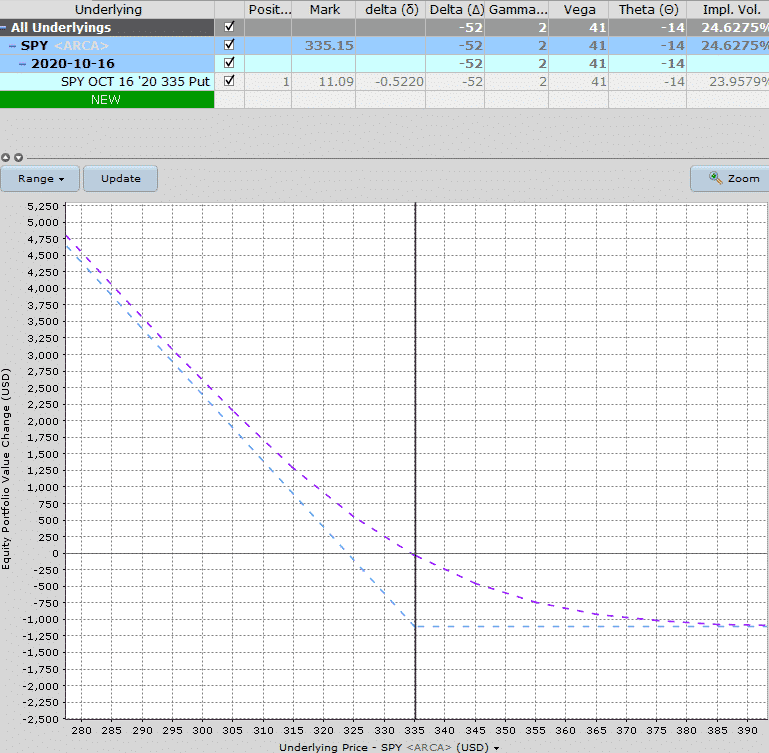

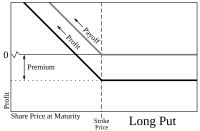

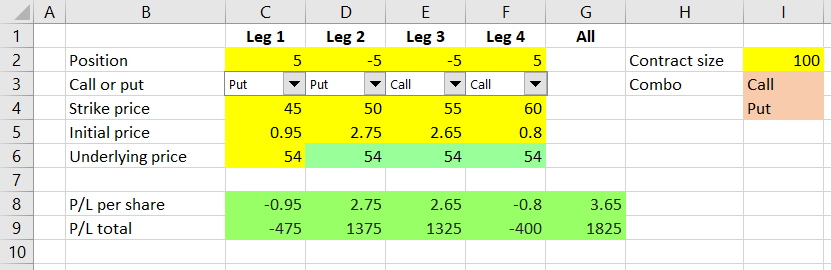

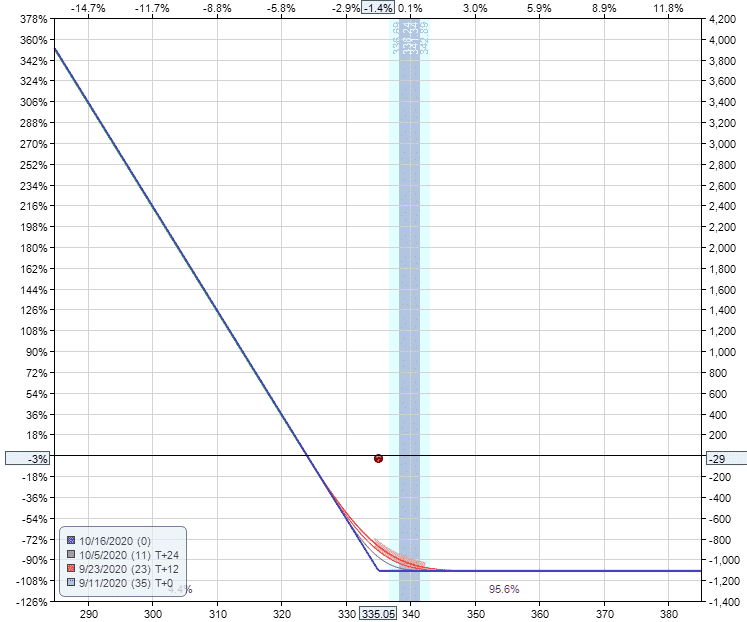

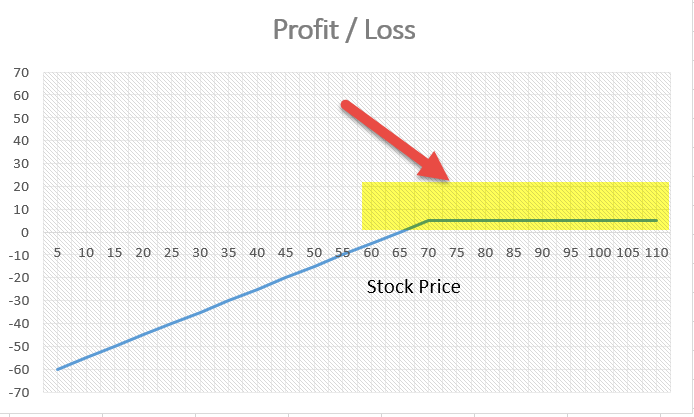

Put option payoff diagram. We will look at: A put option’s payoff diagram All the things that can happen with a long put option position, and your profit or loss under each scenario Exact formulas to calculate put option payoff Calculation of put option payoff in Excel Calculation of a put option position’s break-even point ... The payoff diagram shows how the option's total profit or loss (Y-axis) depends on underlying price (X-axis). The key variables are: Strike price (45 in the example above) Initial price at which you have bought the option (2.88 in the example) Current underlying price (the chart's X-axis) One decision we need to make is the range of underlying prices that our payoff diagram will cover. To make our spreadsheet good for different underlying securities with different price levels, we should make the range dynamic. For example, for options on a stock trading at $15 it would probably be enough to display a range from 0 to, let's say, 30, but for another stock trading in the triple digits we will need a much wider range. We will make the underlying price range easy to change by setting up two cells for user input ? chart start in cell I5 and chart increment in cell I6, as the screenshot below shows. Cell B12, which will be the first point on the chart's X-axis, will be set equal to cell I5: Cell B13, which will be the second point on the chart's X-axis, will equal the first point plus the increment. The formula in cell B13 is: Make sure to use relative reference for the first point (B12) and absolute reference for the increment ($I$6). This will enable us to copy the formu... Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position’s total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: What we are looking at here is the payoff graph for a bear put spread option strategy.

A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: What we are looking at here is the payoff graph for a short put option strategy. Nov 10, 2021 Option profit & loss or payoff diagrams help us understand where our options strategies win or lose money at expiration based on different stock price points. It's also important that you understand how they work because they can help you build complex options strategies and adjust trades. Options Option Contracts Payoff Diagram A convenient way to envision what happens with option strategies as the value of the underlying asset changes is with the use of a profit and loss diagram, ... What we are looking at here is the payoff graph for a bull put spread option strategy. In this example the trader has sold a $315 strike put and bought a $310 strike put for a net $0.96 per contract (or $96 for a standard option contract representing 100 shares). The premium collected of $96 is the most the trade can profit.

A profit and loss diagram, or risk graph, is a visual representation of the possible profit and loss of an option strategy at a given point in time. Option traders use profit and loss diagrams to. It will show the payoff diagram for our strategy. This diagram shows the option's payoff as the underlying price changes for the long put position. If the stock is above the strike at expiration, the put ... options: call options and put options. Call and Put Options: Description and Payoff Diagrams A call option gives the buyer of the option the right to buy the underlying asset at a fixed price, called the strike or the exercise price, at any time prior to the expiration date of the option. The buyer pays a price for this right. Payoff of short put option = min (S T - X, 0) or - max (X - S T, 0) We can calculate the Payoff of Mr. XYZ for all the three scenarios assumed in the above example. Scenario -1 (when the option expires deep in the money) The payoff of Mr. XYZ = min (S T - X, 0) = min (60 - 70, 0) = - $10/- Scenario -2 (when the option expires in the money)

Option Strategy Pay-Off Diagram Builder | Stockezee Zerodha (₹20/Trade) Open Account Angel Broking Flat ₹20 per trade Aliceblue Get 0% Commission 5 Paisa ₹0 Account Opening Option Strategy Spot Price: More on Stockezee Nifty & BankNifty Live Open Interest Charts Live Intraday Put Call Ratio Live Open Interest Nifty Live Open Interest BankNifty

Sep 23, 2020 · Put Option Payoff Graph. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position’s total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: What we are looking at here is the payoff graph for a long put option strategy.

And so you have a payoff diagram that looks something like this. It kind of hockey sticks. Below $50, it's worthless, and then above $50, all of a sudden, it becomes worth something. Now, if you do it in the profit and loss model, all you have to do is incorporate what you actually paid for the option.

Payoff diagram for Put Options. http://www.financial-spread-betting.com/ PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! A put option gives us the rig...

if i were to buy a put option with a $50 exercise price and if i were to buy it for $10 then the value of my position the payoff for that put option at the maturity or at the expiration i should say at the expiration of the option depending on what the stock price is that expiration will look like this if the stock price is worth if the stock …

Feb 06, 2017 · Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of options. As option probability can be complex to understand, P&L graphs give an instant view of the risk/reward for certain trading ideas you might have.

To Open your Demat & Trading account with Fyers Securities, Please click on below link http://partners.fyers.in/AP0209 Please fill in your details, Fyers rep...

Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below:

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

0 Response to "41 put option payoff diagram"

Post a Comment